Cloud-native clearing, Settlement, Execution, and Custody platform

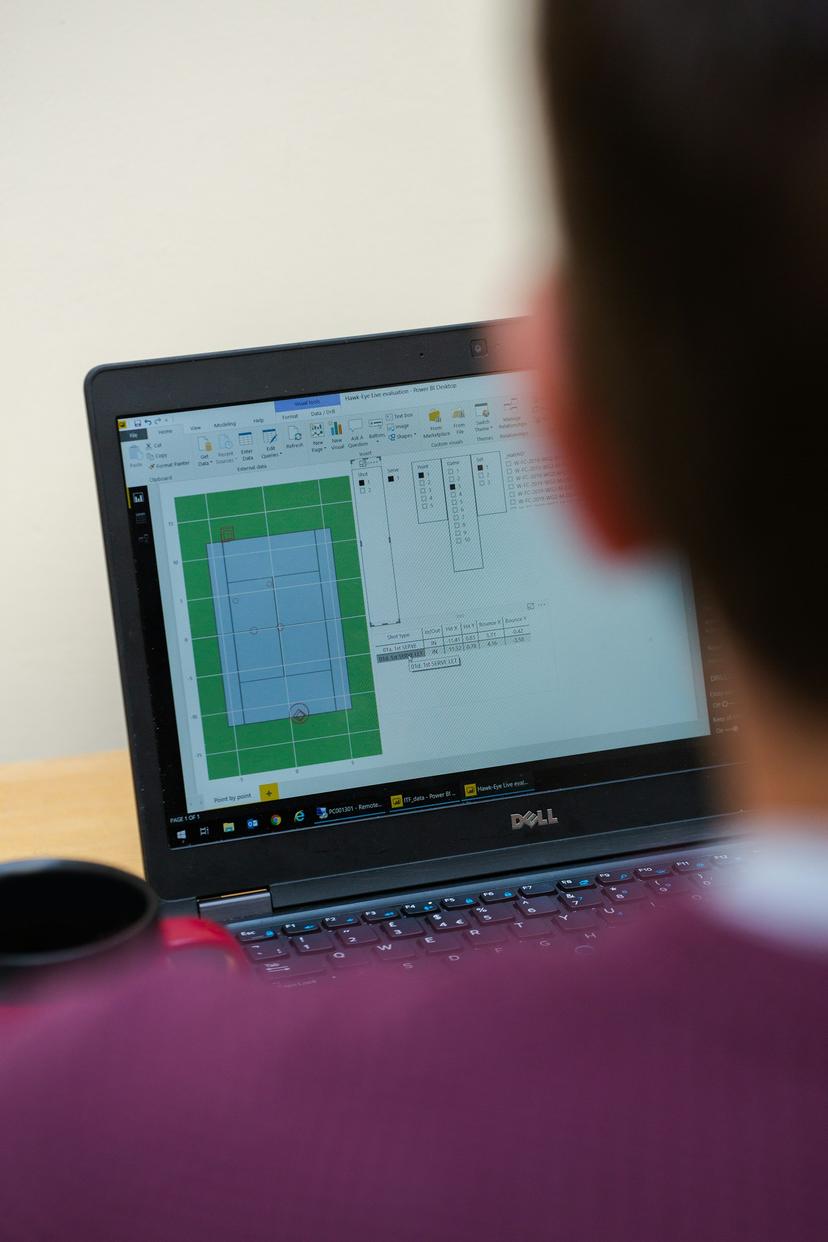

Pacsquare's cloud-native architecture is designed to leverage modern cloud computing infrastructure. It utilizes microservices that enhance the system's modularity and maintainability, making it easier to update, replace, or scale individual components without affecting the entire system. Containers play a crucial role in Pacsquare's infrastructure. It packages applications and their dependencies, ensuring consistent and reproducible environments across development, testing, and production stages. The use of container orchestration tools, allows Pacsquare to efficiently manage and scale containerized applications, ensuring high availability and quick response times.

Explore our solutionsFeatures of Back Office Clearing Solutions

Benefits of Back-Office Clearing

Risk Mitigation: Pac Back-office clearing solution reduces counterparty risk by acting as an intermediary between buyers and sellers. When trades are cleared through a central clearinghouse, the clearinghouse becomes the counterparty to both sides of the trade. This eliminates the risk of default from one party impacting the other.

Netting and Margining:Our Back-office Clearing solutions facilitate multilateral netting, where offsetting positions are aggregated to reduce the number of transactions settled. Additionally, margin processes are employed to ensure that participants have sufficient collateral to cover potential losses, further reducing risk exposure.

Liquidity Enhancement:By centralizing clearing and settlement processes, Pac Back-office clearing can enhance market liquidity. It facilitates faster and more reliable transactions, encouraging increased trading activity.

Access to Diverse Markets: Pac Back-office Clearing solutions can provide participants with access to a broader range of markets and financial instruments. This access allows investors to diversify their portfolios and manage risk more effectively.

Collateral Management: Pac Back-office Clearing monitor and manage collateral requirements, ensuring that participants maintain adequate assets to cover their positions. This collateral management process reduces systemic risk and promotes financial stability.

Blogs

Fintech and its futureThe financial services sector's market results are changing as a result of the digital revolution.Tue, June 2, 2022

Trends in the software industryFuture is fully automated. The software industry continues to astonish the masses at large. It is constantly evolving to accommodate new societal needs, external forces, and developing technology.Tue, July 2, 2023

What Blockchain Really is?Blockchain is a decentralized, immutable database that makes it easier to track assets and record transactions in a corporate network. An asset may be physical such as a home, car, money, or property or intangible like patents, intellectual property, copyrights, etc.Tue, Aug 2, 2023

Unlocking a Cashless Future: The Evolution of Digital PaymentsBlockchain is a decentralized, immutable database that makes it easier to track assets and record transactions in a corporate network. An asset may be physical such as a home, car, money, or property or intangible like patents, intellectual property, copyrights, etc.Tue, May 2, 2023

Unleashing the Power of Fintech and AIThe convergence of fintech and artificial intelligence (AI) has given rise to a transformative force that is revolutionizing the financial industry.Mon, May 29, 2023

AI In Stock Market 2024In the ever-evolving landscape of financial markets, protecting assets and maximizing returns are crucial considerations for investors. Artificial Intelligence (AI) has emerged as a transformative force in stock trading, offering new avenues for optimizing trade margins and making faster, more intelligent decisions than traditional approaches.Tue, Nov 21, 2023

Top 07 FinTech Predictions for 2024 and How Pacsquare Takes the LeadAs we approach the year 2024, the FinTech sector is poised for transformative advancements that will reshape the financial industry. The rapid pace of technological innovation is set to usher in a new era where finance becomes not only digitized but also characterized by intelligence and inclusivity. In this exploration, we delve into the top 10 FinTech predictions for the coming year, offering insights into the trends that will serve as game-changers in the financial landscape.Tue, Dec 12, 2023

Introducing the Power of API TradingFinancial technology is the new cool kid on the block, and it's changing the game faster than you can say "bull market." Imagine a world where trades zip through the digital realm, markets are under constant surveillance, and portfolios get VIP treatment – all thanks to the powerhouse known as API trading. In this blog, let’s explore the fundamentals of API trading, its applications, the reasons behind its widespread adoption in the financial industry, the specific purposes it serves, the benefits, the audience it caters to and the best strategies for API Trading.Fri, Jan 12, 2024

Revolutionizing Clearing Applications: Navigating the Future of Digital TransactionsIn the dynamic realm of technology, clearing applications play a vital role in facilitating seamless transactions across various industries.Thu, Mar 28, 2024